- Safety & Recalls

- Regulatory Updates

- Drug Coverage

- COPD

- Cardiovascular

- Obstetrics-Gynecology & Women's Health

- Ophthalmology

- Clinical Pharmacology

- Pediatrics

- Urology

- Pharmacy

- Idiopathic Pulmonary Fibrosis

- Diabetes and Endocrinology

- Allergy, Immunology, and ENT

- Musculoskeletal/Rheumatology

- Respiratory

- Psychiatry and Behavioral Health

- Dermatology

- Oncology

Cell and Gene Therapies Present Challenges to Payers

In the future, payers plan to leverage reinsurance and value- or outcomes-based contracting to provide access to high-cost therapies.

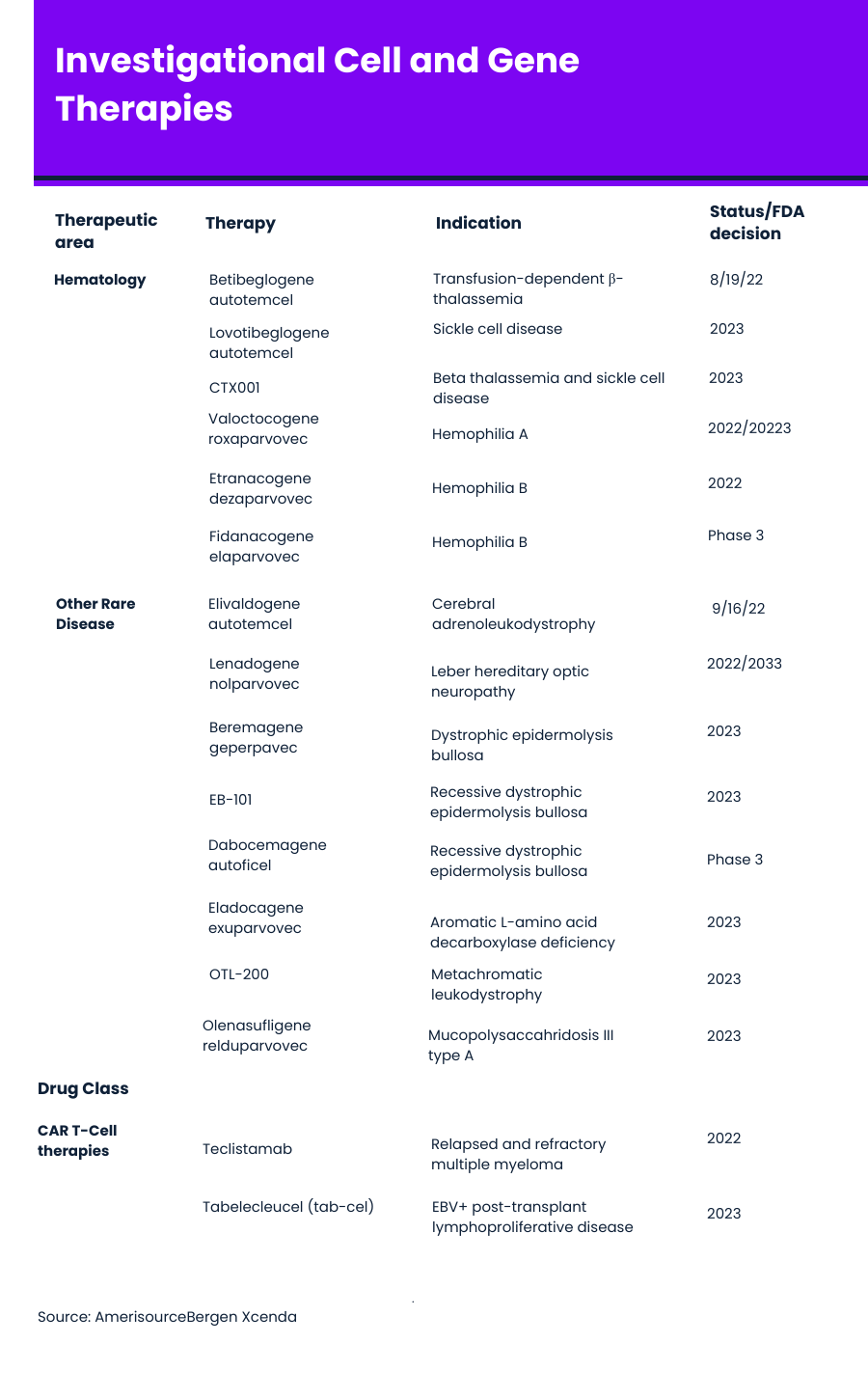

With eight cell and gene therapies currently on the market — and several FDA decisions on other therapies expected later this year — concerns about how to provide patient access and insurance coverage are rising. A growing pipeline of cell and gene therapies that address more than 100 diseases has payers taking notice, often earlier in development to begin planning for these high-cost treatments. (See table below for cell and gene therapies in late-stage development.)

Tasmina Hydery, Pharm.D.

“Payers are monitoring the cell and gene therapies, as early as phase 1 and phase 2 trials, compared with traditional drugs, where payers may not review until phase 3 data becomes available or around FDA approval,” Tasmina Hydery, Pharm.D., assistant director, integrated technology solutions and FormularyDecisions team lead at AmerisourceBergen's Xcenda, said in an interview with Formulary Watch. “Manufacturers of these cell and gene therapies are engaging payers early on making sure that they’re sharing any clinical data on efficacy, durability, as well as any insights on pricing as it becomes available.

In a recent webinar, Hydery and Milda Kaitz, associate director, reimbursement & policy insights at AmerisourceBergen's Xcenda, shared that payers are open to newer methodologies for covering gene and cell. Most payers currently use traditional techniques, such formulary or utilization management tools to manage cell and gene therapies. In the future, however, the majority of payers plan to leverage reinsurance as well as increasing their use of value-/outcomes-based contracting.

But Kaitz said in an interview that there are a lot of unanswered questions around cell and gene therapies. “There is concern among payers about the high cost and how to pay for it. They’re looking at the value that this high-cost therapy will bring. A lot are still concerned that providers may not be identifying the right patient for these therapies,” she said.

Another payer question, Hydery said, is whether these products are durable or not. “There are such limited long-term data on these therapies because the clinical trial is for a finite period of time. But what happens if the CAR T-cell therapy doesn't work? Or, even though a gene therapy was intended to be curative, what if the patient comes back with the disease? Payers are looking at the high up-front costs and not really knowing whether they will be effective.”

Milda Kaitz

Kaitz said patient access is complicated by the fact that each step in the process of treatment with cell and gene therapies has its own coding and reimbursement nuances. “The drug is only as good as the access and reimbursement for providers because if they don’t know or follow those reimbursement steps, they won’t get paid.”

Pharmaceutical companies are offering a variety of pay-over-time and value-/outcomes-based programs. One example of a value-based contracting is Novartis’ Zolgensma (onasemnogene abeparvovec-xioi) to treat spinal muscular atrophy, a progressive disease of the nerve cells. When it was approved in May 2019, it was launched with an option to pay over five years and an option for an outcomes-based agreement.

Zolgensma is an adeno-associated virus vector-based gene therapy that provides a functional copy of the SMN gene. The one-time treatment costs $2.1 million. Company officials said at the time this price is half of established benchmarks including the 10-year current cost of chronic SMA therapy.

Spark Therapeutics created a similar program outcomes-based and pay-over time programs for Luxturna (voretigene neparvovec-rzyl), which was approved in 2017 as a one-time gene therapy indicated for the treatment of patients with a rare form of inherited blindness. Spark also has contracted directly with insurers for payments for Luxturna to avoid hospitals having to purchase a very expensive therapy and then wait to be reimbursed by insurers.

More recently, in September 2021, Aetna, part of CVS Health, launched a special network, the Gene-based, Cellular, and Other Innovative Therapies (GCIT) network, to help manage the costs Luxturna and Zolgensma, as well as Biogen’s Spinraza (nusineren), another therapy to treat patients with spinal muscular atrophy. Beginning Jan. 1, 2022, patients could access these therapies through designated providers.

Bluebird Bio, which has two gene therapies now being reviewed by the FDA, has suggested in the past it would likely use installment plans for betibeglogene autotemcel (beti-cel) and elivaldogene autotemcel (eli-cel).

Beti-cel’s, which is being developed for the treatment of people with beta-thalassemia who require regular red blood cell transfusions, has a PDUFA date of Aug. 10, 2022.In June 2022, an FDA advisory committee vote was unanimous in saying the benefits of beti-cel outweigh the risks.

Beti-cel is a one-time gene therapy adds functional copies of a modified form of the beta-globin gene into a patient’s own hematopoietic stem cells. Beti-cel uses the Lenti-D lentiviral vector (LVV)—HIV type 1 cells that have had their genetic information removed—to add beta-globin gene.

The Institute for Clinical and Economic Review anticipates beti-cel could be priced at $2.1 million with a potential for with an 80% payback option for patients who do not achieve and maintain transfusion independence over a five-year period.

Eli-cel, which is being developed to treat cerebral adrenoleukodystrophy (CALD), a rare, progressive, neurodegenerative disease that primarily affects young boy, has a PDUFA date of Sept. 16, 2022. Once again, an advisory committee voted unanimously on the question about the benefits outweighing the risks.

Eli-cel also uses the Lenti-D lentiviral vector to add functional copies of the ABCD1 gene into a patient’s own hematopoietic stem cells. The addition of the functional ABCD1 gene allows patients to produce the ALD protein, which is thought to facilitate the breakdown of very long-chain fatty acids. The expression of ALD protein and effect of eli-cel is expected to be life-long.

Xcenda researchers in a separate report said Medicaid best price (MBP) policy could limit manufacturers’ willingness to enter into value-based agreements. This requires that a drug manufacturer offer state Medicaid programs the best price they offer to any other organization or a discount of 23.1% off the list price.

But the Centers for Medicare & Medicaid Services (CMS) recently implemented a new rule for Medicaid that was announced in December 2022 that would provide flexibility to encourage manufacturers and states to enter into value-based agreements for state Medicaid programs.

Beginning July 1, 2022, manufacturers can report varying multiple best prices for a covered outpatient drug to the Medicaid Drug Rebate Program (MDRP) if associated with a value-based purchasing (VBP) arrangement, according to a CMS press release.

Payers Recognize the Benefits, but Still See Weight Loss Drugs through a Cost Lens

April 12th 2024Jeffrey Casberg, M.S., R.Ph., a senior vice president of clinical pharmacy at IPD Analytics LLC, a drug intelligence firm that advises payers and pharmaceutical companies, talks about how payers are thinking about weight-loss drugs.

Humira Biosimilars Have a Slow Uptake, Finds Samsung Bioepis Report

April 8th 2024Caps on Medicare Part D cost sharing as a result of the Inflation Reduction Act, could reduce members’ financial incentive for switching to a biosimilar, suggests the newest Samsung Bioepis Quarterly Biosimilar Market Report.