- Safety & Recalls

- Regulatory Updates

- Drug Coverage

- COPD

- Cardiovascular

- Obstetrics-Gynecology & Women's Health

- Ophthalmology

- Clinical Pharmacology

- Pediatrics

- Urology

- Pharmacy

- Idiopathic Pulmonary Fibrosis

- Diabetes and Endocrinology

- Allergy, Immunology, and ENT

- Musculoskeletal/Rheumatology

- Respiratory

- Psychiatry and Behavioral Health

- Dermatology

- Oncology

Drugs to Watch: Cancer

Developing novel drugs to treat cancer remains a strong focus for drug developers. Several first-in-class therapies have become available over the last few months.

Cancer is a big focus of drug development. The number of products in development to treat cancer continues to grow, with more than 2,000 products currently under development, according to IQVIA Institute for Human Data Sciences. Oncology trial starts in 2022 were up 22% from 2018.

More than 100 new oncology drugs are expected to launch in the next five years. Cancer drugs now launch at higher prices than they have in the past. The number of new cancer drugs with costs exceeding $200,000 per year has been increasing, accounting for 44% of launches in the past five years, IQVIA says. This is lead IQVIA predicts spending on cancer will reach $375 billion globally by 2027, up from $196 billion in 2022.

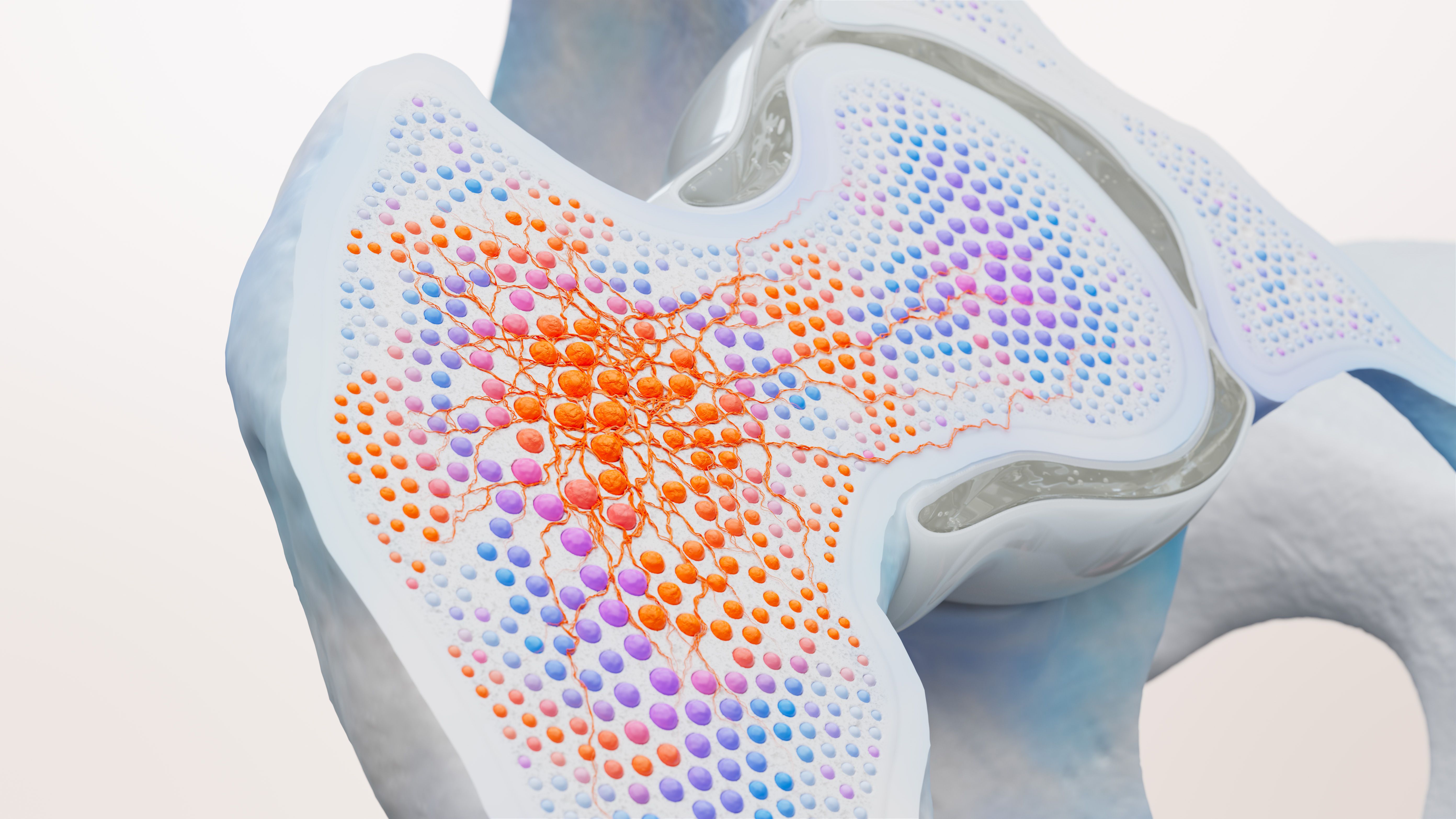

Myelofibrosis is a cancer of the bone marrow and can lead to anemia. Shown here is a stylized rendition of bone marrow and fibrosis.

Photo courtesy of GSK

Among the most recent approvals is GSK’s Ojjaara (momelotinib), the first to treat adult patients with anemia who have intermediate or high-risk myelofibrosis, a bone marrow cancer. Ojjaara has a list price of $26,900 for a bottle of 30 tablets.

Myelofibrosis affects about 25,000 patients in the United States and is potentially fatal. At diagnosis, about 40% of patients are anemic and nearly all with the disease will eventually develop anemia. Ojjaara can inhibit three key signaling pathways: Janus kinase (JAK) 1, JAK2 and activin A receptor type 1 (ACVR1). Inhibition of JAK1 and JAK2 may improve symptoms and enlarged spleen; inhibition of ACVR1 leads to a decrease in circulating hepcidin, which is often elevated in myelofibrosis and contributes to anemia, according to a news release from GSK.

In August, two multiple myeloma therapy were approved. Multiple myeloma is an aggressive and currently incurable blood cancer that affects plasma cells made in the bone marrow, and more than 35,000 new cases of multiple myeloma are diagnosed annually in the United States.

The first of these therapies is Talvey (talquetamab-tgvs), which was granted accelerated approval to treat adult patients with relapsed or refractory multiple myeloma. It is indicated for patients who have received at least four prior lines of therapy. Developed by Johnson & Johnson Innovative Medicine (formerly Janssen Pharmaceutical Company), Talvey is a weekly or biweekly subcutaneous injection after an initial step-up phase.

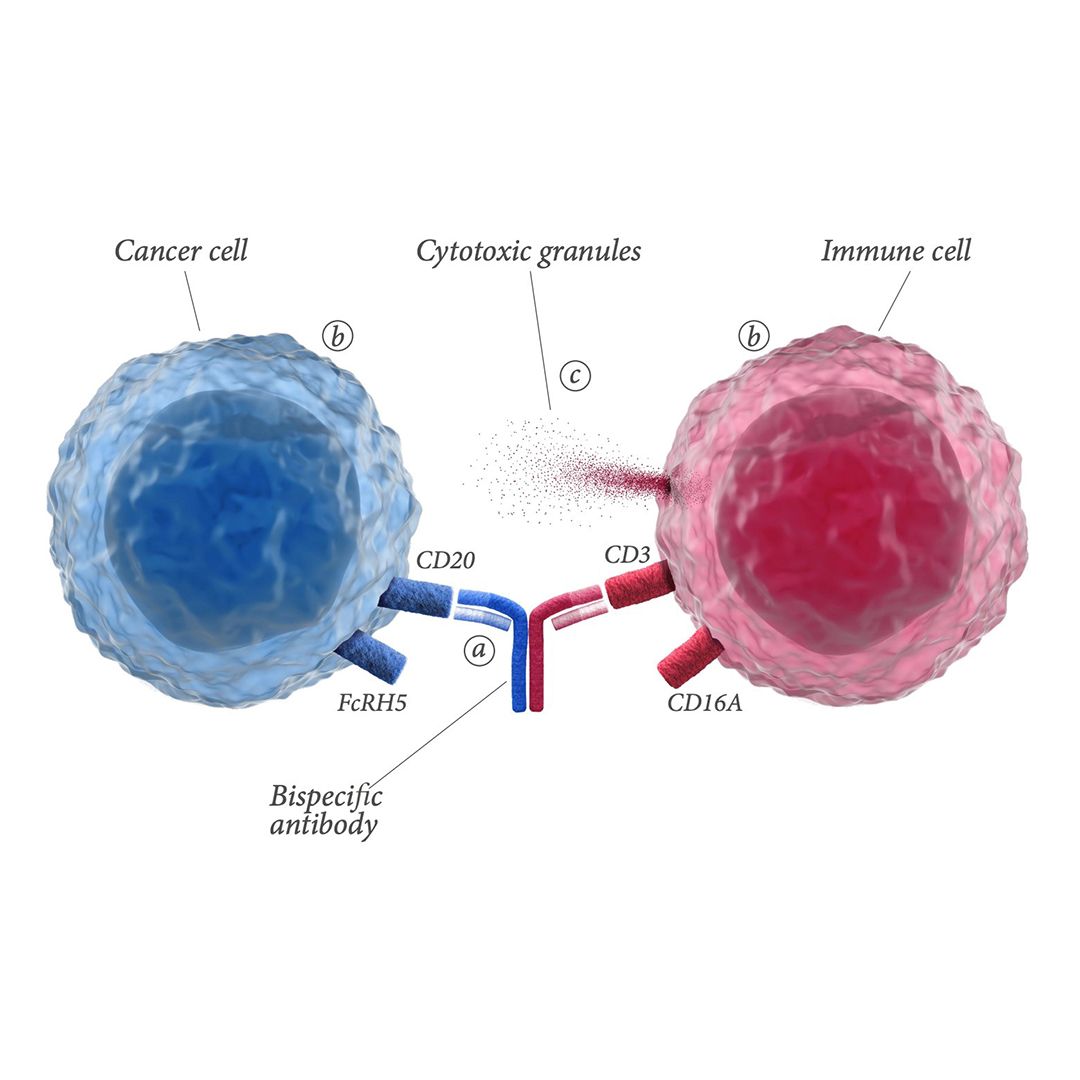

Bispecific antibodies simultaneously bind to targets on the surfaces of cancer cells and immune cells. After binding, immune cells are redirected to cancer cells. This results in T-cell-mediated destruction of cancer cells via the release of cytotoxic granules.

Talvey is a bispecific antibody that targets both CD3 receptor on T cells and GPRC5D. CD3 is involved in activating T cells, and GPRC5D is overexpressed on multiple myeloma cells. It will be available in the next few weeks and will have a price of $45,000 per month, for a range of $270,000 to $360,000, based on the typical average treatment duration of six to eight months in the clinical trial, according to a company spokesperson. The company expects Talvey will be covered by Medicare and most commercial insurance plans.

The FDA also granted accelerated approval to Pfizer’s Elrexfio (elranatamab-bcmm) to treat adult patients with relapsed or refractory multiple myeloma. It is indicated for patients who have had at least four prior lines of therapy.

Elrexfio is a subcutaneously delivered B-cell maturation antigen (BCMA)-CD3-directed bispecific antibody immunotherapy. It binds to BCMA on myeloma cells and CD3 on T-cells, bringing them together and activating the T-cells to kill myeloma cells. It is the first BCMA-directed therapy in the United States with the option for every-other-week dosing after 24 weeks of weekly treatment.

Elrexfio will have a list price of $7,556 for the 44 mg vial and $13,051 for the 76 mg vial, or a monthly price of $41,500, which a spokesperson said is similar to other approved multiple myeloma therapies. The company expects the monthly price to be lower (about $26,000) as patients move to bi-weekly dosing.

Pfizer offers patients the support of Patient Access Navigators, through the Pfizer Oncology Together program, who provide personalized services for all aspects of treatment, including financial assistance resources, treatment support, and resources to navigate potential insurance and coverage issues.

A confirmatory trial (MagnetisMM-5) involving 854 patients began in 2022.

Earlier this year, the first two bispecific antibodies for relapsed or refractory diffuse large B-cell lymphoma (DLBCL) received FDA approval. DLBCL is an aggressive, hard-to-treat disease and is a fast-growing non-Hodgkin lymphoma. About 30% to 40% of patients will experience relapse or progression, and patients who experience relapse have poor outcomes.

Epkinly (epcoritamab-bysp), developed by AbbVie Inc. and Genmab A/S, was approved in May 2023 and became available in June, and a month later, Genentech Inc.’s Columvi (glofitamab-gxbm) was approved. Both are bispecific antibodies that are made up of two proteins engineered to recognize two different targets at the same time.

Both Epkinly and Columvi target CD3 on the surface of T cells and CD20 on the surface of B cells. This dual targeting brings the T cell closer to the B cell, activating the release of cancer cell-killing proteins from the T cell.

Columvi differs from Epkinly, however, in that it is a fixed-duration therapy with 12 treatments and an estimated cost of about $350,000 for the entire treatment cycle. Epkinly is a monthly therapy with a cost of $37,500 per month. Epkinly copay assistance is available through Genmab’s MyNavCare program. The current maximum benefit is $25,000 per year.

Epkinly has been added to the National Comprehensive Cancer Network Guidelines for B-Cell Lymphomas and is listed as a category 2A recommendation for third-line and subsequent treatment of patients with DLBCL, including patients with disease progression after transplant or chimeric antigen receptor T-cell therapy.

IQVIA indicates in a recent report that 130 bispecific antibodies are in development for cancer indications, with 67% being studied for solid tumors.

Among upcoming approvals within oncology, is a potential first-in-class therapies are under review at the FDA. Capivasertib, an AKT kinase inhibitor developed by AstraZeneca. The PI3K/AKT/PTEN signaling pathway participates in the regulation of cell growth. In breast cancer, dysregulation of the AKT pathway is closely related to tumor progression and resistance to standard therapies. Inhibiting the pathway has the potential to overcome resistance to anti-hormonal therapy and chemotherapy.

Capivasertib is being reviewed by the FDA as an oral therapy, along with Faslodex (fulvestrant), to treat patients with hormone receptor-positive, human epidermal growth factor receptor 2-negative advanced or metastatic breast cancer. The FDA’s target date is in the fourth quarter of 2023.

In a phase 3 trial, capivasertib plus Faslodex demonstrated a 40% reduction in the risk of disease progression or death versus placebo plus Faslodex in the overall trial population. Median progression-free survival was 7.2 months versus 3.6 months. The trial continues to assess overall survival as a key secondary end point.

FDA Approves Xolremdi for Ultra Rare Immune Disorder

April 29th 2024Xolremdi is the first therapy for WHIM syndrome, which can cause recurrent lung infections and papillomavirus-related warts. It’s available in two doses: 400 mg for an annual cost of $496,400 and 300 mg for an annual cost of $372,300.

FDA Approves Pfizer’s Gene Therapy Beqvez for Hemophilia

April 26th 2024Beqvez (fidanacogene elaparvovec) is priced at $3.5 million, which is on parity with Hemgenix, the first one-time therapy to treat adults with hemophilia B. Pfizer’s warranty will refund insurers and continue to provide coverage for patients if they change insurers.