- Safety & Recalls

- Regulatory Updates

- Drug Coverage

- COPD

- Cardiovascular

- Obstetrics-Gynecology & Women's Health

- Ophthalmology

- Clinical Pharmacology

- Pediatrics

- Urology

- Pharmacy

- Idiopathic Pulmonary Fibrosis

- Diabetes and Endocrinology

- Allergy, Immunology, and ENT

- Musculoskeletal/Rheumatology

- Respiratory

- Psychiatry and Behavioral Health

- Dermatology

- Oncology

Semaglutide for Weight Loss: To Cover or Not Cover?

Ozempic, Wegovy and other GLP-1 drugs present a challenge to payers in terms of costs and outcomes, finds PSG’s new Drug Benefit Design Report.

Health plans and employers are grappling with whether and how to cover the newer weight loss drugs, according to the newest Trends in Drug Benefit Design Report from Pharmaceutical Strategies Group (PSG). The report, which was sponsored by Rx Savings, surveyed 180 employers, health plans and unions about their drug benefit plan design. New this year was a spotlight on obesity and coverage of the newer weight-loss drugs. Almost 42% of U.S. adults have obesity, according to the Center for Disease Control. Obesity can lead to cardiovascular disease, type 2 diabetes, joint problems and other conditions.

PSG survey respondents were divided on whether weight loss is a lifestyle or chronic condition, and 43% cover FDA-approved weight loss medications. Of respondents, 28% said they may cover these products in the next 1 to 2 years.

Currently, Novo Nordisk’s Wegovy (semaglutide) is approved to treat chronic weight management in patients 12 years old and older who have at least one weight-related condition (such as high blood pressure, type 2 diabetes, or high cholesterol). Novo Nordisk also sells the product as Ozempic to treat patients with diabetes. Additionally, Novo Nordisk sells Rybelsus, an oral semaglutide to treat diabetes. Semaglutide works by mimicking a hormone called glucagon-like peptide-1 (GLP-1) that targets areas of the brain that regulate appetite and food intake.

Renee Rayburg, R.Ph.

Semaglutide has gotten a lot of media coverage, but more anti-obesity drugs are expected, and at least 10 drugs are in the pipeline, Renee Rayburg, R.Ph., vice president, specialty clinical consulting, at PSG, said during a recent webinar. The next drug likely to be approved for weight loss is Lilly’s Mounjaro (tirzepatide), which is currently approved to treat patients with type 2 diabetes. In April, Lilly released data that showed adults taking Mounjaro achieved up to 15.7% weight loss.

GLP-1 drugs have become so popular for weight loss that they are being used off-label by people who don’t have diabetes, and the increased demand has created drug shortages. And while earlier this year, Novo Nordisk indicated that it is producing and shipping all dose strength, high demand continues to exceed supply.

Related: FDA Warns About Certain Compounded Semaglutide Products

Ozempic, Wegovy and other GLP-1 drugs are also expensive and present a challenge to payers. One carton of four prefilled pens of Wegovy has an average retail price of $1,569, according to GoodRx.

Of the plans that don’t cover the FDA approved weight loss drugs, PSG found that 34% of respondents said they were too expensive and 19% had concerns that the medication did not lead to long-term weight loss. And there is some evidence that long-term weight loss is not achieved. In March 2023, Novo Nordisk released a study that found that patients could gain back about half of the weight lost in two to three years after stopping Wegovy, and after five years, be back to their original weight,”.

“I believe that everyone understands that there are positive health benefits to the weight loss,” Rayburg said. “Plans are trying to figure out how to do that, whether to put in prior authorizations, step therapy, etc. Others may be waiting for more information.”

Separately, Goodroot — a community of companies that aim to increase the affordability and access to healthcare — released a guidance to employers about semaglutide and other GLP-1 drugs for weight loss. They indicated in their report that a study showed that those using weight loss medications had decreased healthcare costs in the second year, while untreated patients saw rising costs.

Of the plans and employers surveyed by PSG that do provide coverage for weight loss drugs, 22% require members to participate in a lifestyle modification program as a prerequisite for medication coverage. Another 20% said participation in such a program is voluntary.

“Lifestyle changes definitely need to be made to sustain the weight loss,” Rayburg said. “There are companies — Calibrate is one such company — that assist patients taking these drugs to make lifestyle behavioral changes.”

PSG found that 14% of those who provide coverage said they placed limits on coverage just as duration or quantity limits. But only 16% said they measure the outcomes of obesity medications and another 36% said they are planning to do so. “When there is no utilization management on these drugs, we’ve seen a high of 72% of members who are on these drugs not have a diagnosis of type 2 diabetes,” Rayburg said.

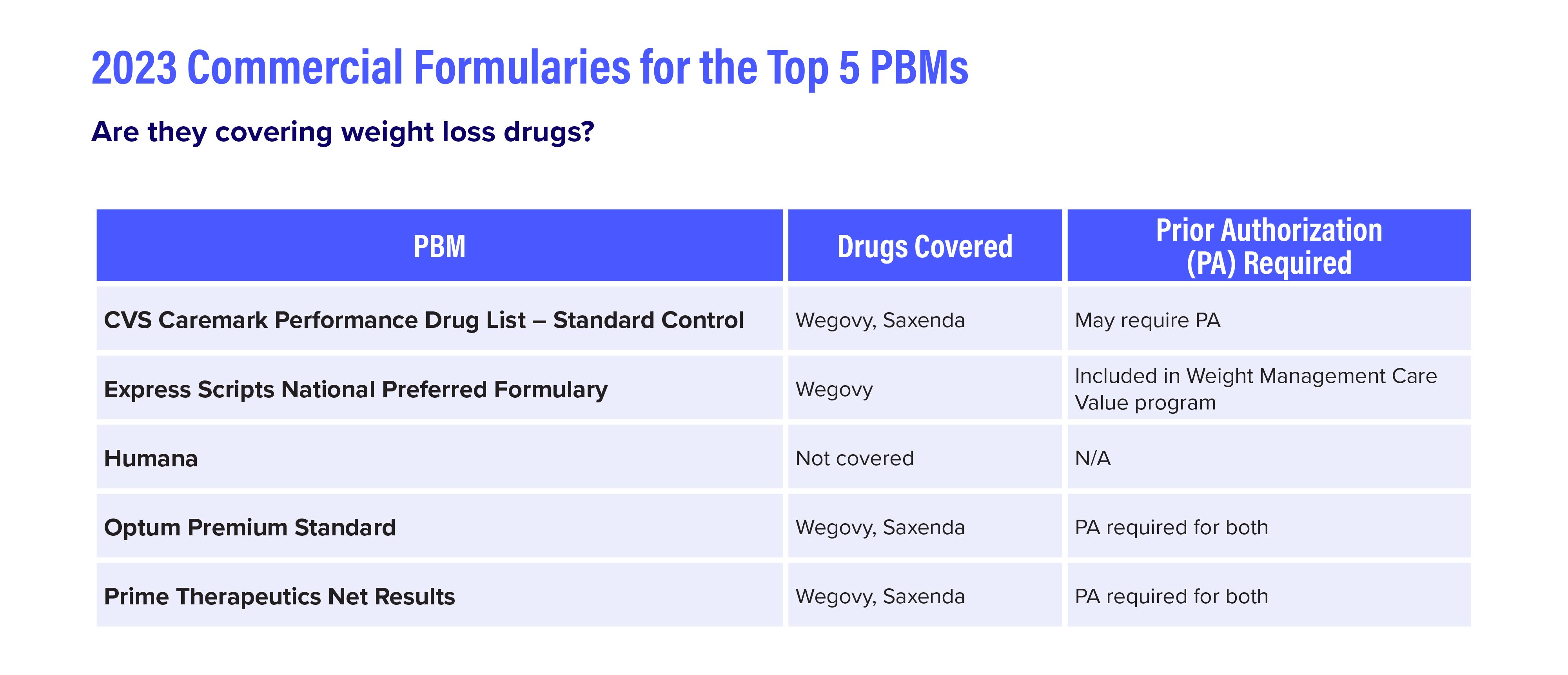

The top PBMs cover Wegovy and Saxenda (liraglutide), which Novo Nordisk introduced in 2014 for weight loss, but with prior authorization required. (See table below). Liraglutide is also available as Victoza to treat type 2 diabetes.

Michael Medel, Pharm.D.

“I don’t agree with just adding these drugs to the formulary [without limitations], because that’s $14,000 or $15,000 a year that you’re going to have to bear the expense of whether the drugs are working or not,” Michael Medel, Pharm.D., senior vice president, practice lead, plan sponsors, said during the webinar. “It’s extremely prudent to have some type of outcomes measurement as part of the coverage of these medications.”

Other trends from the PSG report:

- Utilization management programs: Growing percentages of respondents cite cost and cumbersomeness as barriers to utilization management programs. Most respondents are looking for improvements in utilization management programs and more transparency and accountability about costs and outcomes.

- Gene therapy financial protection products: Most (91%) respondents have heard of gene therapy financial protection products. While just 7% currently use these products, nearly half are considering it.

- Formulary management: A little over half of plans (53%) take steps to identify and reduce wasteful spend in the formulary.

- Cost Sharing: The promotion of cost-sharing transparency tools to help members manage expenses continues to rise, from 28% in 2018 to 63% in 2023.

Source: Goodroot